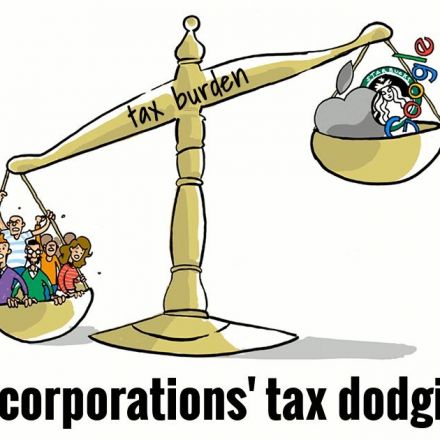

EPI and ATF highlight the $700 billion multinationals owe on their offshore profits

America’s biggest and most powerful corporations continue to claim they are damaged by the 35 percent U.S. corporate tax rate when it comes to international competition, but the facts prove that simply isn’t true. A newly-released online resource compiled by Americans for Tax Fairness and the Economic Policy Institute shows U.S. corporate profits are near record highs while revenue from corporate taxes is near record lows, as a share U.S. GDP, over the last six decades. Moreover, multinational corporate effective tax rates are one half or less than the statutory rate.

Continue Reading

Join the Discussion