-

+1 +1

+1 +1Flunkies, goons and managerial feudalism: why David Graeber’s Bullshit Jobs is the book that keeps on giving

In 2013, anthropologist David Graeber wrote an article for an obscure, left-wing magazine. It spawned a book – and a turn of phrase – that became a cultural phenomenon.

-

+18 +1

+18 +1Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

-

+15 +1

+15 +1CEOs are enjoying huge paydays while their workers struggle to pay bills

Despite all the buzz about the “Great Resignation” and a renaissance for the working classes in America, a new report finds the gap between executive and worker pay is only widening. The typical low-wage worker’s pay didn’t keep pace with inflation last year at more than a third of the companies reviewed by the Institute for Policy Studies, a progressive think tank. IPS’ survey included the 300 publicly traded companies with the lowest median pay for workers.

-

+4 +1

+4 +1Why it's harder to earn more than your parents

In the 21st century it's got harder to earn more than your parents and to climb the social ladder. What's gone wrong, and what can be done to change this?

-

+3 +1

+3 +1Boss not giving you a raise this year? With inflation this high, it could be time to quit

Inflation has risen to its highest point in a generation, pushing up the price of just about everything. But that goes for people's labour, too, as employers compete to keep up with their staffing needs.

-

+21 +1

+21 +1Costco raised its minimum wage to $17 an hour

Costco this week raised its starting wage for hourly store workers in the United States for the second time this year as businesses hike pay to draw and retain workers amid a labor shortage. Costco (COST) told employees last week that it would increase its minimum wage from $16 an hour to $17 starting on Monday. Costco has around 180,000 US employees, and 90% of them work hourly.

-

+20 +1

+20 +160% of millennials earning over $100,000 say they're living paycheck to paycheck

High-earning millennials are feeling broke. Sixty percent of millennials raking in over $100,000 a year say they're living paycheck to paycheck, according to a new survey by PYMNTS and lending company LendingClub which analyzed economic data and census-balanced surveys of over 28,000 Americans.

-

+17 +1

+17 +1Tasks, Automation, and the Rise in US Wage Inequality

We document that between 50% and 70% of changes in the US wage structure over the last four decades are accounted for by the relative wage declines of worker groups specialized in routine tasks in industries experiencing rapid automation. We develop a conceptual framework where tasks across a number of industries are allocated to different types of labor and capital.

-

+14 +1

+14 +1Survey Shows People No Longer Believe Working Hard Will Lead To A Better Life

A growing sense of inequality is undermining trust in both society’s institutions and capitalism, according to a long-running global survey. The 2020 Edelman Trust Barometer – now in its 20th year – has found many people no longer believe working hard will give them a better life.

-

+16 +1

+16 +1U.S. job growth picks up; wages increase solidly

U.S. employers boosted hiring in May and raised wages as they competed for workers, with millions of unemployed Americans at home likely because of childcare issues and generous unemployment checks. The Labor Department's closely watched employment report on Friday offered some assurance that the economic recovery from the pandemic recession was on track after worker shortages also blamed on lingering fears over COVID-19 sharply restrained employment growth in April.

-

+16 +1

+16 +1Tax codes that reward traditional families might increase income inequality

Tax codes that offer extra benefits to breadwinners with dependents negatively affect countries ability to reduce income inequality across family types and could exacerbate existing gender inequality by discouraging secondary earners from labor-market participation, according to new research.

-

+20 +1

+20 +1Inequality Would Widen if U.S. Policies Spur Sustained Inflation

Federal Reserve and Biden administration officials say economic inequality is bad and they aim their policies in part at helping to reduce it. In the short run, at least, those policies might be widening inequality, not shrinking it.

-

+16 +1

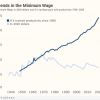

+16 +1This is What Minimum Wage Would Be If It Kept Pace with Productivity

Until 1968, the minimum wage not only kept pace with inflation, it rose in step with productivity growth. The logic is straightforward; we expect that wages in general will rise in step with productivity growth. For workers at the bottom to share in the overall improvement in society’s living standards, the minimum wage should also rise with productivity.

-

+22 +1

+22 +1Why Millennials Can’t Grow Up

A few weeks ago, I met my first Millennial grandparent. I was interviewing a woman in her late 30s about President Joe Biden’s new child-tax-credit proposal, and she mentioned that it would benefit not just her two young kids but her older son’s kid too.

-

+16 +1

+16 +1The Making of the Mother of All Economic Booms

Lael Brainard is the hero of the hour

-

+11 +1

+11 +1US unemployment claims drop to a pandemic low of 498,000

The number of Americans seeking unemployment benefits fell to 498,000 last week, the lowest level since the viral pandemic struck 14 months ago and a sign of the job market’s growing strength as businesses reopen and consumers increase spending.

-

+4 +1

+4 +1Decision fatigue: loan applications processed around midday more likely to be rejected

A new study from Cambridge University shows that bank credit officers are more likely to approve loan applications earlier and later in the day, while ‘”decision fatigue” around midday is associated with defaulting to the safer option of saying no.

-

+13 +1

+13 +1Everything Screams Inflation

We could be at a generational turning point for finance. Politics, economics, international relations, demography and labor are all shifting to supporting inflation. After more than 40 years of policies that gave priority to the fight against rising prices, investor- and consumer-friendly solutions are becoming less fashionable, not only in the U.S. but in much of the world.

-

+16 +1

+16 +1How the Federal Reserve Is Increasing Wealth Inequality

The Fed’s low-interest-rate policies have stabilized the economy and turbocharged the stock market. But those who don’t own lots of stocks haven’t benefited anywhere near as much as those who do.

-

+23 +1

+23 +1Biden: Trickle-down economics "has never worked"

During his joint address to Congress on Wednesday, President Biden spoke of the need to tax the ultra-wealthy to fix economic inequality in the U.S.

Submit a link

Start a discussion