How can I learn Trend Following trading?

Learn actionable tips and strategies for trading uptrends and downtrends to profit from stocks, forex, cryptocurrencies

-

Technical Analysis: Trend Following for Investment as well as Trading

Technical Analysis :

Technical analysis assumes that all information studied by fundamental analysis is already reflected in the PRICE of a given stock. It is a method employed to evaluate stocks by analyzing statistical trends gathered from trading activity, such as price and volume.

Trend Following: What is that?

There are forces of nature that function with their own characteristics. Eg. Gravity. It is an invisible force that ensures that everything stays down on earth. Anything threw up in the air simply falls down due to gravitational force. Similarly in investing and trading price trend is an important force. Surprisingly price trend is the cause as well as the effect impacting prices.

Movement becomes effortless or with the least resistance when one goes in the direction and in sync with various forces at play. Stock prices move in trends. Trends can be major of 2 types: Uptrend and Downtrend. Sometimes when the market is not trending it can be said to be flat.

It makes sense to follow something that works. That is why Trend Following!

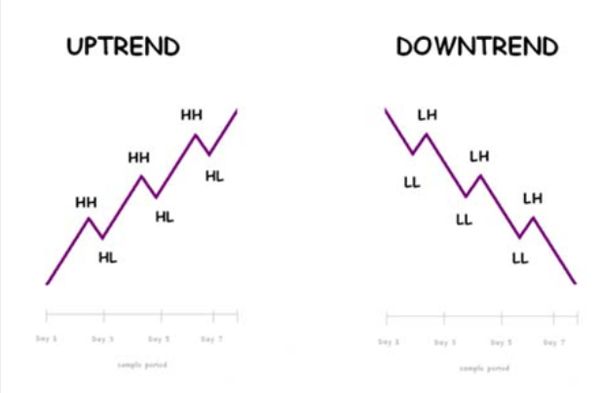

HH=Higher High LH=Lower High HL=Higher Low LL=Lower Low

Trends can form on all time-frames namely Hourly, Daily, Weekly, Monthly. From an investor perspective, it is important to analyze and study trends on higher time-frames like weekly and monthly charts. From a trader's perspective as the horizon is smaller it will make sense to study hourly or daily time-frame charts. Price trends on higher time-frames have more impact on the stock prices in the long-run.

Uptrend :

In an uptrend, the stock price tends to make a series of Higher High(HH) and Higher Lows(HL).

All the Lows are higher than the previous Lows indicating that there is constant demand at declines which eventually leads to higher prices in the future.

As the natural momentum is upward the stock price which is in uptrend moves effortlessly on the higher side. Investors must invest only in those companies which are in an uptrend on higher time-frames of weekly and monthly charts.

Learn how to trade trends in forex, cryptocurrency and stock markets : https://www.udemy.com/course/trading-trends-f...tocurrency/?referralCode=33043AB5137A01191CD3

Downtrend :

In a downtrend, stock price tends to make a series of Lower High(LH) and Lower Lows(LL).

All the Highs are lower than the previous Highs indicating that there is constant supply at upsurge which eventually leads to lower prices in the future.

As the natural momentum is downward the stock price which is in downtrend moves effortlessly on the lower side. Investors must always avoid investing in those companies which are in a downtrend on higher time-frames of weekly and monthly charts.

Trend is your friend until it bends !

-

Join the Discussion