-

+17 +1

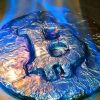

+17 +1After bitcoin slumps 70% in 2018, the digital currency’s fans look for a rebound

The crypto true believers who stuck around through the slump also hope that 2019 brings an influx of institutional investors to the market. That effort could get a boost when Intercontinental Exchange Inc. -- the parent of the New York Stock Exchange -- launches its crypto-focused exchange, Bakkt, which will allow customers to buy, sell, store, and spend digital currencies.

-

+3 +1

+3 +1CryptoTaxes: How Much Bitcoin is taxed?

On September 7, finance ministers from the European Union met in Vienna to discuss the volatile nature of digital assets. Theirs but also other politicians’ concern about cryptocurrencies is in regard to crypto’s general lack of transparency and their potential to get misused by black marketers.

-

+15 +1

+15 +1A Place Under The New Year Tree.What to expect from cryptocurrencies closer to the New Year’s Eve?

If at the end of October 2017, Bitcoin cost about $ 5.5 thousand, then its price already reached $20 thousand on December 18. Most of the Altcoins rushed right after the first cryptocurrency — they began to consistently set the historical maximums of value, day after day improving indicators. For example, Stellar cryptocurrency showed growth of 1,300% from November to January, and the XRP token, which increased by 1,750% over the same period, later became notorious among investors who were not lucky enough to invest in an asset at the peak (now it cost almost ten times cheaper).

-

+16 +1

+16 +1Wall Street Quietly Shelves Its Bitcoin Dreams

Goldman Sachs, Morgan Stanley and many more built it. But they didn’t come.

-

+17 +1

+17 +1Report claims Bakkt's Bitcoin futures contract launch might be delayed

It could be a while before Bakkt could get its Bitcoin futures contract approved. A new report claims that the CFTC’s [Commodity Futures Trading Commission] decision-making process has been progressing slow regarding Bakkt’s Bitcoin futures contract. Looking at CFTC’s current pace, the futures contract wouldn’t be launched at the desired time, said a CoinDesk report citing sources.

-

+7 +1

+7 +1Bitcoin’s Fair Market Price is $14,800, Says Cryptocurrency Bull Tom Lee

Cryptocurrency bull Tom Lee says bitcoin’s dismal price of roughly $3,400 is wrong because its actual fair market value is $13,800 to $14,800. The Fundstrat founder said he made the assessment by considering the number of active wallet addresses, usage per account, and supply metrics. “Fair value is significantly higher than the current price of Bitcoin,” he wrote in a note, as reported by Bloomberg.

-

+14 +1

+14 +1Renowned Global Investor Predicts Fall Of US Dollar And Bets On Chinese Market

Jim Rogers, author of “A Bull in China: Investing Profitably in the World’s Greatest Market” and a renowned investor who co-founded the first global investment fund with George Soros in 1973, has made numerous extraordinary predictions about trade market in the past, including the fall of the US dollar. He last predicted the crash of U.S. real estate in 2006 before the subprime crisis happened in 2007. As a pioneer of investment in China’s shares in the 90’s, Rogers has an extensive understanding of the red dragon economy and believes some Chinese industries have a rich future ahead.

-

+14 +1

+14 +1FAANG Stocks Lose Over $1 Trillion, More Than All Cryptocurrencies Combined

Bitcoin and cryptocurrencies, in particular, are not the only bubble in town. Stocks of tech stalwarts like Google, Amazon, and Facebook, collectively knowns as FAANG, have lost over $1 trillion USD in market capitalization from their all-time highs. Comparatively, despite a nightmare year for cryptocurrencies, the total cryptocurrency market cap is down roughly $700 billion from its $830 billion historic high in January 2017.

-

+6 +1

+6 +1Bitcoin is close to becoming worthless

Just one year has passed since bitcoin enthusiasts forecasted that the cryptocurrency would hit a price of $1 million. But that was then. With the price of bitcoin BTCUSD, -1.45% having fallen almost 80% from its peak, and now trading well-below the support level of $6,000, everyone is wondering where it goes from here.

-

+11 +1

+11 +1Federal Reserve Says 2018 Bear Market Was Caused By CME’s Bitcoin Futures Offering

While many people had glossed over this little-known statement released by the Federal Reserve earlier this year (in May), but according to the letter, the government body blamed the launch of Bitcoin futures markets on the Chicago Mercantile Exchange (CME) for adversely affecting the overall value of Bitcoin (as well as many other alt-assets available in the market today).

-

+11 +1

+11 +1Bears maul Bitcoin yet again; Price under $4k with 7% losses

Though there was a sigh of relief on November 29, when the coin broke the $4,400 barrier, it soon lost its holding at UTC 13:00 yesterday. The coin lost almost $350 off its value in under 6 hours, piling up its losses to 7.27% for the day. Apart from Bitcoin, every single coin that features in the top 30 cryptocurrencies has seen red. Losses range between 5% to 12%, with the recent sensation, Bitcoin SV being the biggest loser in the top 10 coins with a loss of 12.63%.

-

+10 +1

+10 +1A Site Enabling Anyone to Buy Bitcoin Using 300 Payment Methods Says the Demand is Growing

An organization that permits guests to shop for Bitcoin the use of greater than 300 fee strategies has reported enlargement within the collection of transactions being finished the use of US bucks – and says it’s made up our minds to dismantle the problems folks have in incomes and moving their cash freely. Paxful used to be introduced in 2015, and has the function of constructing it easy to shop for cryptocurrency – a boon for individuals who haven’t completed so earlier than.

-

+11 +1

+11 +1Have You Lost Your Cryptocurrency Savings?

Bitcoin boasted an annual return that beat Facebook and Google by 800% in recent years through 2017, yet these are just headlines. On the higher end of the scale, fast lane traders at Boss Crypto made 2340% in 2017 and more than doubled those gains during the 2018 bear market. While most people lost the almost their entire cryptocurrency investment, a select few had the training, principles and strategies in place to capitalise.

-

+21 +1

+21 +1Overstock surges 26% after CEO says it will sell retail business by February to focus on crypto

Overstock plans to sell its decades-old retail business in the next few months to make way for a full-blown bet on blockchain. The previously announced sale plans could go through as soon as February, the company's CEO told The Wall Street Journal in a report published Friday. Overstock founder and CEO Patrick Byrne — an ardent believer in the technology that underpins bitcoin and other cryptocurrencies — declined to name any of the potential buyers.

-

+2 +1

+2 +1Forbes: Vanguard Lowers Index Fund Fees For Millions Of Retail Investors

Vanguard, one of the world’s largest investment management companies with $5.3 trillion in global assets under management, announced today that they are lowering the investment minimums on 38 Admiral Shares index funds to $3,000.

-

+17 +1

+17 +1Bitcoin Price Drops Below $6,000 for First Time in Months as $13bn Wiped off Markets

The cryptocurrency ecosystem is currently going through a red day as most top cryptocurrencies are currently taking a hit, with some dropping over 20% in the last 24-hour period. The cause behind the massive downswing is, at press time, unclear.

-

+2 +1

+2 +1Ethereum’s Joe Lubin: Blockchain Will ‘Take a Little Longer’ to Develop Than the Web

ConsenSys CEO Joseph Lubin said that his firm is interested in “promoting the [Ethereum] ecosystem” rather than “controlling it.” Blockchain will “probably take a little longer” to develop than the internet, because it is “much more complicated,” ConsenSys creator Joseph Lubin told German media outlet t3n in an interview, Cointelegraph auf Deutsch reported Nov. 9. Lubin, who is also the co-founder of Ethereum (ETH), told reporters that blockchain technology is developing in a similar way to the web, citing its exponential growth with “hundreds of projects that are already practical for humans” to date.

-

+3 +1

+3 +1Tom Lee Believes BTC Could Still End The Year At $25,000

When Bitcoin is experiencing its lowest levels of volatility in history and remaining within a short trading range of $6,300 and $6,500, yet Lee is still confident that the currency could end 2018 on a high note. Fundstrat’s Tom Lee has always been one of Bitcoin’s biggest bulls. For several months, despite the wavering price of everybody’s favorite cryptocurrency, Lee has stuck to his guns and remained adamant that the currency could end the year at an even $25,000.

-

+14 +1

+14 +1Partnership Could See up to 100,000 Regular ATMs in U.S. Turned into Bitcoin-Vending Machines

A deal between a traditional ATM manufacturer and a cryptocurrency vending machine firm will make it possible to buy bitcoin at tens of thousands of locations in the United States using a debit card. Bitcoin ATM firm LibertyX and regular ATM manufacturer Genmega have forged a partnership which will make it possible to purchase bitcoin using a debit card at up to 100,000 locations in the United States.

-

+14 +1

+14 +1Financial institutions have already started accumulating bitcoins - far from the public eye

Institutional investors are at the forefront of trading in crypto currencies, according to a report published yesterday. These investors, who in some cases represent hedge funds, have displaced individuals with greater purchasing power as the biggest bitcoin buyers, after making private transactions, some of them as large as [EDITED a mistake – not $100k but $100 M] $100 million in the over-the-counter (OTC) market.

Submit a link

Start a discussion