9 years ago

2

7,500 Faceless Coders Paid in Bitcoin Built a Hedge Fund’s Brain

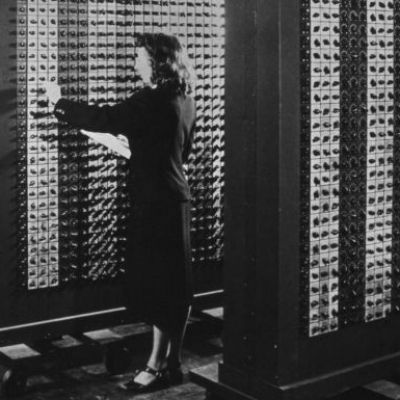

RICHARD CRAIB IS a 29-year-old South African who runs a hedge fund in San Francisco. Or rather, he doesn’t run it. He leaves that to an artificially intelligent system built by several thousand data scientists whose names he doesn’t know. Under the banner of a startup called Numerai, Craib and his team have built technology that masks the fund’s trading data before sharing it with a vast community of anonymous data scientists. Using a method similar to homomorphic encryption, this tech works to ensure that the scientists can’t see...

Continue Reading

Additional Contributions:

Join the Discussion

That's a hefty 1.2% just for payouts. Assuming another 1-2% for the fund manager, we're looking at a fund with 2-3% in costs. Would investors really beat the market with those kinds of expense ratios?

I'd like to know, too.

Standard fee for managing a hedge fund is around 2% (although that might change).

The way I understand it as a layman, is that the whole point of a hedge funds is that the firm managing funds is hedging investments taken out to limit risk of other investments (insurance is an example of a real-world hedge) on your behalf. The fee you pay as an investor is to the managing firm not to have to hedge bets yourself. They do it for you at 2%.

As a result, you are guaranteed a loss of 2% on your investment (in fees), hoping gains on returns will be above 2% putting you in a net positive (low risk, low return). If you invest yourself, you are not guaranteed any loss (0 fees) but you do risk a loss of anything up to and including 100% if you don't understand financial instruments well enough to hedge correctly (higher risk, higher reward).

I'm assuming that, in general, at 2% fees, investors gain on returns with hedge funds and this fund is pretty well par for the course in terms of fees. The remaining question is - does it yield higher returns than a conventional hedge fund?

It would be great to hear from someone from the industry, tho...